Unlocking member satisfaction: What an AFCA insider says about effective member communications

/Author: Erin Weaver

Industry Perspectives: Interview with AFCA Lead Ombudsman, Superannuation, Heather Gray.

At Mayflower Consulting, we have always believed that effective member communication goes a long way in building solid relationships between a fund and its members, upholding member satisfaction. We’ve basically built a business around this very concept.

However, we never rest on our laurels, and take every opportunity to meet with and learn from other experts operating in our shared space.

One of those experts we were fortunate to interview recently is Heather Gray, Lead Ombudsman at AFCA for superannuation. Heather’s impressive career spans across superannuation and financial services law and she has consulted to all the key regulators affecting the superannuation industry. After watching her present on this topic, we recognised her insight would be invaluable to us and our industry peers.

In our interview with Heather, she shared recent figures on superannuation complaints, as well as current themes observed by AFCA. This prompted further questioning and discussion around the inherent characteristics of a superannuation fund and its members as contributing factors to the continuing rise in complaints.

Importantly, we were keen to hear Heather’s perspective on some of the areas where small improvements could be made to create positive impact around the complaints handling process within a superannuation fund. Of course, we especially wanted to hear her thoughts on the role of communications.

First, the stats that gave birth to this interview

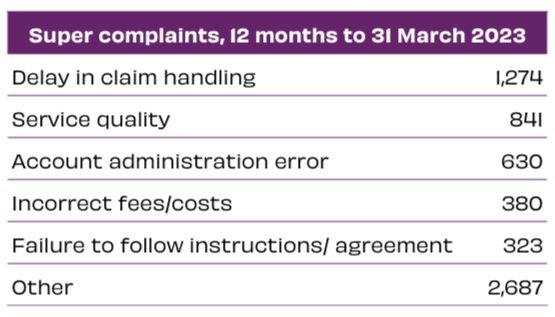

In the aforementioned presentation, Heather provided the following statistics on the number of superannuation complaints received by AFCA in the 12-month period ending 31 March 2023, with the total figure of 6,135 marking a significant increase on the previous year.

The importance of quality member service to a super fund

Interestingly, when combining service quality, account administration error and failure to follow instructions or agreement under one theme, issues concerning the management of membership and accounts represent 30% of total superannuation complaints.

We were curious that such a large percentage of complaints were around service – surely a business that operates solely for its members would invest heavily in member services and communications.

Doing a quick scan of some of the major superannuation funds’ websites, the homepage and marketing messages are all focused on fees, investment performance and profits. With the same messaging across nearly every fund, where can the changes be made to set a fund apart from others? Surely, it’s at the less visible level of member service, in the call centre, over email, live chat and all the smaller touchpoints between the fund and its members. This is where the majority of engagement between the fund and members happen and where there is the greatest opportunity to build those relationships. Unsurprisingly, it is also at this level that dissatisfaction can brew if things aren’t running smoothly.

It’s easy to attribute complaints to system errors, relaying incorrect information or just general low quality of service but in speaking to an insider, we were keen to understand some of the underlying issues and inherent characteristics of the superfund business that can lead to member dissatisfaction.

Superannuation is a large and complex beast

On this, Heather commented, “Superfunds are a high-volume business, by nature. Most of the time, things are going right but for the small percentage of time when it doesn’t, this translates to a large amount of complaints”.

“Even if you’re one of the smaller funds in the game, you are still operating with significantly more money and clients/members than the average large business. There are countless ways to get the member satisfaction not quite right, increasing the risk of complaints.”

“We are now seeing the emergence of giant superannuation funds, so this issue isn’t going away any time soon. Realising that we can’t shrink the industry at this stage, it would be assumed that complaints would increase as funds continue to scale up. Left unchanged, internal dispute resolution teams will remain busy and require more and more resources, further burdening the fund. Members will eventually lose confidence in their fund and look elsewhere.”

Conveying highly technical information

Heather was quick to acknowledge the immense challenge of balancing the need to communicate crucial information, meet compliance requirements, and ensure said information is user-friendly for all members. Your average member does not have a high level of financial literacy and so there is significant risk that comprehension gets lost in technical, exhaustive language.

When the comprehension breaks down so much that the member loses eligibility for a product or is denied insurance benefits for example, this creates significant problems for the fund.

Producing effective communications for members is not as simple as making your policy document clear and concise of course, but that’s a topic for another day. Of course, if you want to read more, we’ve written a previous article on this very topic.

Mismatched expectations

Remembering that your average member does not have the financial literacy to fully understand many of their fund’s product and services, where are they getting their financial advice?

From interactions with members, Heather has found that many of these members seek no external financial advice and look to their fund to fulfil that role. They expect the fund to know them well, understand their circumstances and guide them appropriately in their financial decisions. But those expectations are often not realistic.

General feedback from members is that they expect a very high level of service from their fund. Depending on what that high level of service entails, a fund may not be able to deliver, either legally or on an operational level.

Sounds like a hard fix – what next?

Continuing on from the underlying issues, obvious questions arise that all funds need to be addressing internally:

If a fund continues to scale up, how can it prepare for the inevitable increase for the rise in member complaints?

What communication strategies can be employed to ensure crucial information is being delivered and understood by members?

Where should the fund invest additional resources to create the most significant impact on their service quality?

How can a fund motivate their members to be more involved in their financial well-being and be empowered to make decisions on their own?

Now, Rome wasn’t built in a day, and we all know how difficult it is to make big changes in a super fund.

Here’s a starting point

We couldn’t resist asking Heather one last question to close out the interview – if she had one golden rule superannuation funds should follow to minimise interactions with AFCA, what would it be? Heather provided not one golden rule but three!

1. Invest in your internal dispute resolution team

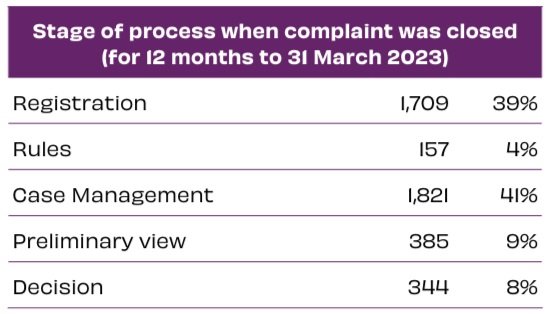

The good news is that most of you seem to be on the same page with Heather on this. As you can see in the table, the majority of the superannuation complaints received by AFCA that were resolved in the last year were done so at registration stage. Very promising.

2. Communicate well

We could write several more pages on these two words, easily. We’ll save them for a future article. In the context of this article and keeping your nose clean with AFCA, Heather has the following advice: “we really want to see that the key points members need to know are hammered home and easy to understand”.

If you don’t know what the key points are, have a look at what members are complaining about as a first effort. That should give you a good indication.

Heather mentioned insurance as a particularly sticky area across the sector, citing a general gap in knowledge for members. Taking care to ensure that difficult concepts are conveyed as clearly as possible, even if it means going over the top, will put you in a good position. As Heather says, “it’s not sufficient anymore to bury important information in a 100-page PDS in 8pt font”.

3. Take accountability

Respond to members with an appropriate level of attention. Trustees should be prepared to step in and acknowledge when something isn’t going right and resolve it quickly.

How can we help?

Glad you asked! As we mentioned, we met Heather through a presentation she recently gave at the NSW ASFA Legislation Discussion Group. Did you know that AFCA have done and will do informational sessions for funds, on request? So helpful.

At Mayflower, we love tackling tricky communications-related problems for superannuation funds and other businesses in the financial services sector. Have a peak at what we do and if you’d like a no-obligation chat (over coffee!) we’d love to hear from you.

Also, if you’re an industry voice and want to be interviewed or contribute a guest blog (or you know of the perfect person we should meet) email erin@mayflower.com.au.